How We Actually Teach Budgeting

After working with hundreds of Australians struggling to manage their money, we've learned something important. Most budgeting advice is too complicated or too simple.

Our approach sits right in the middle. We break down financial concepts into pieces you can actually use, then show you how to apply them to your specific situation.

No spreadsheets with fifty columns. No apps that demand daily updates. Just practical methods that fit into your life as it is right now.

Three Things That Guide Everything We Do

Real Numbers First

We start with your actual bank statements, not theoretical examples. Your spending patterns tell a story, and understanding that story matters more than any budget template ever could.

Build Habits Slowly

Changing how you handle money takes time. We focus on one small adjustment at a time, letting each new habit settle in before adding another layer.

Flexibility Wins

Life doesn't follow a budget perfectly, and that's okay. We teach you how to adjust when things go sideways instead of abandoning the whole system.

Who's Teaching This Stuff

Our instructors have spent years helping people figure out their finances. They've seen what works and what doesn't.

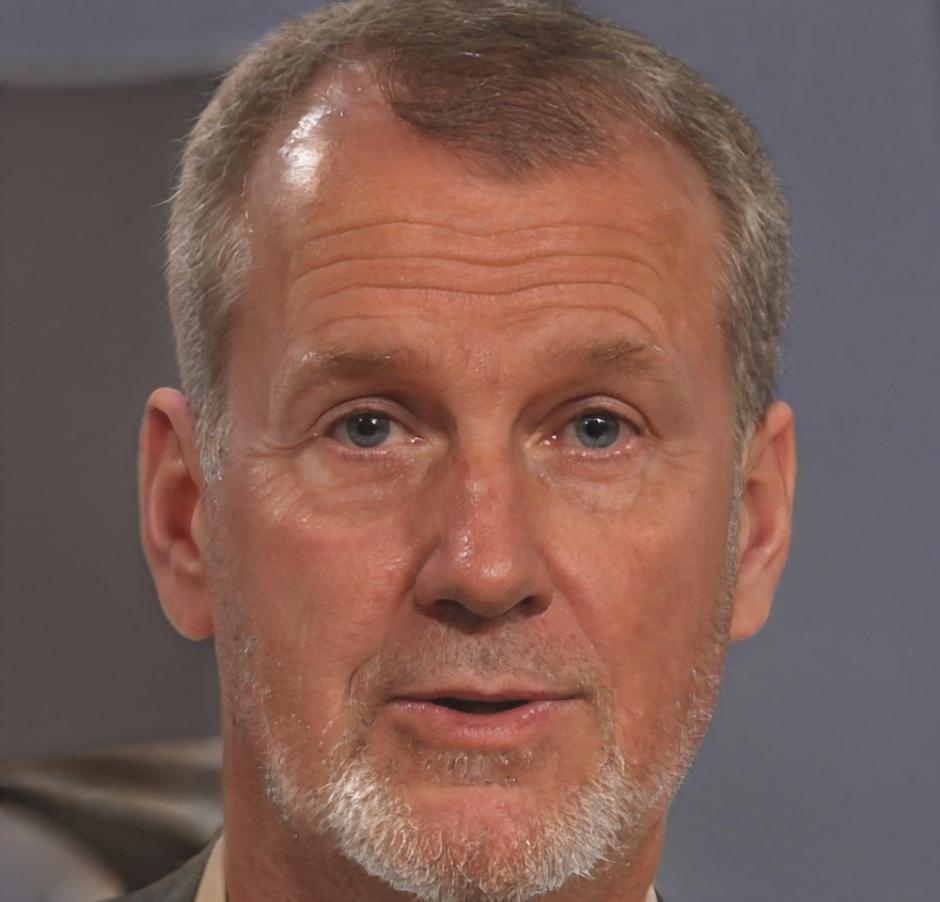

Carrick Davenport

Lead Instructor, Foundation Methods

Carrick worked in financial counseling for twelve years before joining lumivalithiayxo. He's particularly good at helping people who've never tracked expenses before understand where their money actually goes.

His background includes working with community organizations across Tasmania, where he developed simplified budgeting frameworks for people dealing with variable income. That experience shapes how he teaches—he knows not everyone has a regular paycheck.

Whitmore Brennan

Senior Instructor, Advanced Planning

Whitmore focuses on the next stage—what happens after you've got basic budgeting down. He teaches goal-setting methods that actually match your income and timeframes.

Before lumivalithiayxo, he spent eight years helping small business owners separate personal and business finances. That taught him how to explain complex financial concepts without drowning people in jargon.

Thorley Ashford

Instructor, Behavioral Finance

Thorley joined us in 2024 after completing research on spending habits and decision-making. He brings insights about why we make the money choices we do, which helps when you're trying to change patterns.

His sessions focus on identifying your personal spending triggers and building awareness before trying to change behavior. Students often say his approach feels less judgmental than traditional financial advice.